They following image gallery is a sampling of properties represented by Greenback. For property tax

purposes, only the land and building (bricks and sticks) and tangible personal property are taxable.

Any value attributable to intangibles such as service revenue, business value, brand value, superior

management, speculation value, and above market leases are NOT taxable and should be quantified and

deducted in the property tax value report.

Shopping Centers - The value of power centers is dependent on the intangible leasing and management expertise that can attract and retain synergistic tenants. A detailed lease deconstruction is necessary to ensure only the land and buildings are taxed.

|

Banks - Branch banks are designed to increase deposits from a very defined demographic area. A premium is often paid to acquire a site and built a structure that projects strength. However, market value is largely a function of prevailing rental rates in the area for general retail space, and must be considered when valuing banking facilities.

|

Manufacturing - Integrated manufacturing plants are configured for unique processes creating "value-in-use" to the owner/occupant. Since property taxes are based on "value-in-exchange," functional and economic obsolescence must be evaluated to derive a value suitable for alternate

users.

|

Nursing Homes - The revenue generating capability of skilled nursing facilities is largely dependent on obtaining a facility license which entitles the holder to provide 24 hour nursing and rehabilitation care, dietary programs and other services. A careful allocation of revenue and expenses is required to ensure going-concern business value is not taxed.

|

Hotels - Only a portion of the room rate covers the real estate occupied by the hotel guests.The balance pays for occupancy taxes, food, housekeeping services, reservation systems and a recognizable brand name. Separating the non-real estate is essential in arriving at a fair property tax value.

|

Machinery and Equipment - Machinery and equipment are typically valued by assessors using trending schedules based on age and original cost. However, market data from brokers and dealers often proves that assessors' schedules are overstated.

|

Office Buildings - Fee simple market value must be considered when evaluating office buildings. Owners buy buildings based on leased-fee, which is different than the tax code fee-simple definition. To the extent leases are above market or include concessions such as tenant allowances, adjustments must be made to reflect prevailing market conditions.

|

Warehouses - When valuing owner-occupied warehouse space, assessors often utilize a cost approach but only account for physical depreciation which overstates the property tax value. To properly quantify all forms of depreciation, market-derived adjustments for functional and economic obsolescence must be calculated using a pro-forma income study.

|

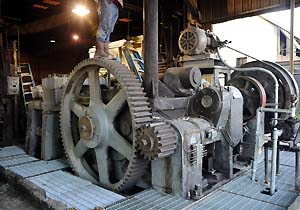

Old Equipment - Some equipment (such as this pre-WWII forging machine) is still in use and providing value to owner. Interviews with the original manufacturer and review of serial numbers and maintenance records usually uncover the information necessary to develop an opinion of fair market value.

|

Flex Space - Flex space is popular among oil service companies and other technical users. When valuing these types of facilities, consideration must be given to special, non-standard buildout and single tenant configuration limitations that affect the market value to alternate users.

|

Strip Centers - Retail strip centers are ubiquitous in the urban landscape. Tenant credit worthiness, lease duration, rent concessions, competition and neighborhood market conditions all are considered to determine fair taxable value.

|

Entertainment Venues - Large-scale, unique entertainment destinations are often so specialized in their construction and layout that finding an alternate user for the facilities would be difficult. Although the owners derive significant value from the tangible assets though the operation of their business, few market participants would be willing to pay a premium price for the underlying buildings and infrastructure.

|

Inventory - Inventory must be adjusted for issues that limit its resale value such as shrinkage, markdowns, custom builds, private label branding and overall inventory mix. Inventories are assembled piecemeal, but valued in bulk for property tax purposes. A volume discount typically applies.

|

Apartments - Multi-family assets experience excessive wear and tear from residents, making repairs and renovations a frequent occurrence to keep the properties competitive. Adequate long-term allowances for roof, parking, HVAC, make-ready and other capital expenses must be calculated and included to determine a fair property tax assessment.

|

High-Tech Equipment - Computer-driven high-tech equipment depreciates rapidly due to advancing technology. These machines also experience heavy duty cycles adding to physical deterioration. Consumables such as dies and bits, and intangibles such as software, must be deducted from the cost of the equipment when determining

fair property tax value.

|

National Chains - National brands construct buildings to a very specific specification, the design elements of which are often a large part of theirbrand identify. The premium paid by the original user is not typically reflected in the value of the property to secondary users.

|

Medical Office Buildings - Doctors and ancillary service providers within medical offices and clinics often have symbiotic relationships. For instance, an orthopedic surgeon may utilize MRI services of his neighbor down the hall and rehab services from another tenant. These opportunities often result in some tenants paying above market rents not attributable to the real estate, and must be discounted for property tax purposes.

|

|